Why Your ICP Targeting Fails With Generic B2B Databases (And What Actually Works)

Your sales team just spent another week chasing leads that went nowhere. The contact data looked perfect on paper: right industry, right company size, decision-maker titles that matched your ideal customer profile. But when your reps actually reached out? Thirty percent bounce rates. Disconnected numbers. People who left the company two years ago.

Sound familiar?

Here’s the uncomfortable truth: most B2B companies are bleeding revenue because they’re using the wrong tools for precision targeting. They’ve defined their ideal customer profile perfectly, invested in expensive databases like Apollo or ZoomInfo, and still wonder why their conversion rates are stuck in the mud.

The problem isn’t your ICP. It’s that you’re trying to hit a bullseye with a shotgun.

What ICP Targeting Actually Means (And Why Most Companies Get It Wrong)

Let’s start with the basics. Your ideal customer profile isn’t just a fancy spreadsheet listing company sizes and industries. It’s supposed to be your north star: the detailed blueprint of companies that will benefit most from your solution and provide the most value back to your business.

When done right, ICP targeting means focusing your entire go-to-market strategy on accounts that match specific firmographic criteria, behavioral patterns, and pain points. You’re not just looking for companies in “healthcare” or “manufacturing.” You’re hunting for mid-size medical device manufacturers in the Northeast who recently raised Series B funding and are hiring compliance officers because new regulations just hit their industry.

That level of specificity is where the magic happens. Companies that nail their ICP targeting see conversion rates jump by two to three times. Their sales cycles shrink by 40-60%. Their customer lifetime value increases because they’re actually selling to people who need what they offer.

But here’s where it all falls apart.

The Generalist Database Trap: Why Apollo and ZoomInfo Can’t Deliver What You Need

Walk into any sales organization and you’ll hear the same story. “We’re using Apollo” or “We just signed a contract with ZoomInfo.” And sure, these platforms have massive databases: hundreds of millions of contacts, companies across every industry imaginable, powerful search filters that make you feel like you can target anyone.

The reality? That breadth is exactly what’s killing your results.

The Data Accuracy Problem Nobody Talks About

Generic B2B databases are built on a fundamentally flawed model: collect as much data as possible, across as many industries as possible, and hope the volume makes up for the gaps in quality.

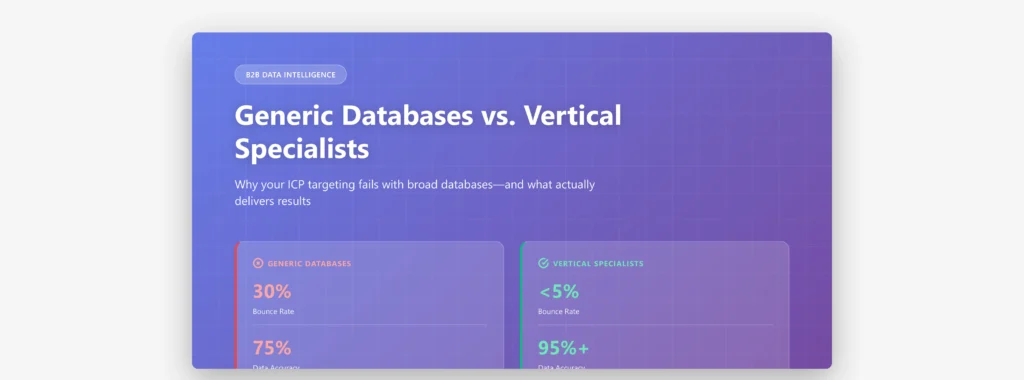

Apollo users consistently report bounce rates hitting 30% or higher, especially for mobile numbers in Europe and emails at startups or lesser-known companies. ZoomInfo users pay premium prices (often ten times more than alternatives) and still find outdated contact information, people who’ve moved roles, and emails that bounce.

Why? Because when you’re trying to maintain accurate data on 275 million contacts across every industry on the planet, you’re guaranteeing mediocrity. Real-time verification doesn’t help when the underlying data collection is surface-level web scraping that can’t capture the nuances of specialized industries.

Think about healthcare. A generalist database might tell you someone is a “Hospital Administrator,” but they won’t know if they’re responsible for procurement decisions, what specific certifications they hold, their NPI number, or which committees they sit on. For a company selling medical devices, that missing context is the difference between closing a deal and wasting three weeks on the wrong contact.

The Missing Data Fields That Actually Matter

Here’s what really happens when you use a generalist approach for vertical targeting. You search for “Chief Technology Officer” at “SaaS companies with 100-500 employees.” You get a list of 5,000 contacts that looks impressive. Then you start reaching out and discover:

- Half the companies are in sub-verticals that don’t actually need your product

- The CTOs you’re contacting aren’t involved in purchasing decisions for your solution

- You have no idea if they’re already using a competitor

- There’s zero context about their tech stack, recent funding, or current initiatives

The database gave you generic firmographic data: industry, size, location. What you actually needed was industry-specific intelligence: Are they using AWS or Azure? Did they just announce a cloud migration? Are they hiring DevOps engineers? Have they been researching solutions like yours?

Generalist databases can’t track those signals because they’re not embedded in your vertical. They’re not attending your industry conferences, monitoring niche job boards, or tracking the publications your ideal customers actually read.

The Compliance and Trust Issues

Let’s talk about something even more troubling. ZoomInfo has faced multiple lawsuits and class actions over privacy violations. They’ve been caught inserting fake contacts into their database to track usage and trigger legal notices against clients who export data. Apollo openly admits to scraping data from millions of websites and requires users to grant them a permanent license to any data uploaded to their system, including your proprietary CRM data.

When you’re doing account-based marketing or building long-term relationships in a specialized industry, this matters. Your buyers in healthcare, legal services, or financial services know about GDPR and CCPA. They care about how their information is being used. Starting a relationship with contacts obtained through questionable data practices isn’t just risky. It’s a terrible first impression.

Why Vertical Specialization Beats Generic Databases Every Time

The most successful B2B companies aren’t using generalist tools for precision targeting. They’re working with specialized data providers who understand their specific vertical inside and out.

Here’s why vertical specialization wins:

Deep Domain Expertise Creates Better Data

When a B2B data provider specializes in two or three verticals, they can afford to go deep. They’re not scraping LinkedIn profiles and hoping for the best. They’re partnering with industry associations, attending niche conferences, conducting manual research on the top companies in that vertical, and creating proprietary data fields that generic providers don’t even know exist.

A healthcare-focused data provider doesn’t just give you a hospital administrator’s email. They give you their NPI number, specialty certifications, hospital affiliations, committee memberships, and prescribing patterns. A manufacturing specialist tracks which trade shows companies attend, what equipment they’re running, their supply chain relationships, and hiring patterns that signal growth.

That’s the difference between a contact and a qualified lead.

Higher Accuracy Because the Stakes Are Higher

Specialist providers can’t hide behind volume. When your entire business depends on maintaining the best data in healthcare or manufacturing, you obsess over accuracy. You implement real-time verification. You manually research hard-to-find contacts. You build relationships that give you access to information generalists can’t touch.

The result? Accuracy rates above 95% instead of struggling to hit 75%. Bounce rates under 5% instead of 30%. Direct dials that actually connect to decision-makers instead of disconnected lines.

Industry-Specific Intent Signals That Actually Matter

Generic intent data tells you someone visited your competitor’s website. Vertical-specific intent data tells you a medical device manufacturer just hired a new VP of Regulatory Affairs, attended the HIMSS conference, and is expanding into two new states. All signals that they’re about to need solutions like yours.

This is the difference between spray-and-pray outreach and strategic account-based marketing. You’re not just targeting companies that match your ICP. You’re targeting them at exactly the moment they’re most likely to buy.

What Precision Targeting Looks Like in Practice

Let’s get concrete. Imagine you’re a SaaS company selling compliance software to pharmaceutical manufacturers. Your ICP says you want mid-size pharma companies with 200-1,000 employees, revenue between $50M-$500M, operating in regulated markets.

With a generalist database, you get a list of pharmaceutical companies that meet those criteria. Maybe 2,000 contacts. You start cold outreach and discover most aren’t actually in regulatory hot water, half already have compliance solutions, and you’re reaching the wrong people inside those organizations.

With vertical specialization, you get a curated list of 200 pharmaceutical manufacturers who are actively hiring compliance officers, recently had FDA inspections, operate in states with new regulations, and are showing digital signals that they’re researching compliance solutions. You know which ones use specific manufacturing systems that integrate with your software. You know who sits on their compliance committees and who actually makes purchasing decisions.

Which approach do you think closes more deals?

The Real Cost of Choosing Wrong

Here’s what keeps me up at night about companies using the wrong data tools: it’s not just about bounce rates or wasted time. It’s about opportunity cost.

Every hour your sales team spends chasing bad leads is an hour they’re not building relationships with companies that actually need your solution. Every dollar you spend on a bloated database contract is money you can’t invest in better targeting. Every prospect who receives your generic outreach because you don’t understand their industry is a relationship you’ve burned before it even started.

B2B buyers are sophisticated. They can tell immediately if you understand their world. When a medical device sales rep calls a hospital administrator and doesn’t know the difference between a GPO contract and a capital equipment purchase, that call is over. When a manufacturing sales rep reaches out without understanding a plant manager’s specific production challenges, there’s no second chance.

Generalist databases give you the illusion of coverage without the depth to actually convert. Specialist providers give you fewer contacts with dramatically higher quality, and that’s exactly what precision targeting requires.

How to Actually Fix Your ICP Targeting

If you’re serious about improving your targeting and qualified lead generation, here’s what needs to change:

First, audit your current data quality. Take 100 contacts from your database and actually try to reach them. What’s your real bounce rate? How many have accurate, current information? How many are actually decision-makers for your solution? If you’re below 85% accuracy, you’re wasting money.

Second, calculate your real cost per qualified lead. Don’t just look at your database subscription cost. Factor in your sales team’s time, your email deliverability scores tanking from bounces, and the opportunity cost of chasing bad leads. When you do the math, that “cheap” Apollo subscription might be costing you $500 per qualified conversation.

Third, find a specialist. Look for B2B data providers who focus on your specific vertical. They might have smaller databases, but if they can deliver 95% accuracy on contacts who actually match your ICP and show buying intent, you’ll close more deals with less effort.

Fourth, demand transparency. Any data provider should be able to tell you exactly where their data comes from, how they verify it, and what their compliance approach looks like. If they can’t (or won’t) explain their methodology, walk away.

Finally, pilot before you commit. The best data providers will let you test their data on a small sample before signing annual contracts. If someone requires a year-long commitment without proving their accuracy on your specific ICP, that’s a red flag.

The Bottom Line on B2B Data Quality

Your ideal customer profile is only as good as the data you use to target it. You can have the most precisely defined ICP in the world, but if you’re using generic databases built for breadth instead of depth, you’re setting your team up for failure.

The companies winning at precision targeting aren’t using the same tools as everyone else. They’re working with specialists who understand their vertical, can deliver the industry-specific data that actually matters, and care enough about quality to guarantee accuracy above 95%.

Because at the end of the day, B2B sales isn’t about having the biggest database. It’s about having the right conversations with the right people at the right time. And that requires data providers who know your industry well enough to tell the difference.

Your ICP deserves better than a generalist approach. Isn’t it time your data provider actually understood the market you’re trying to win?

Ready to see what vertical-specialized B2B data can do for your team? SparkDBi delivers industry-specific contact data with 95%+ accuracy, built specifically for companies that need precision targeting, not just volume. Let’s talk about your ICP.